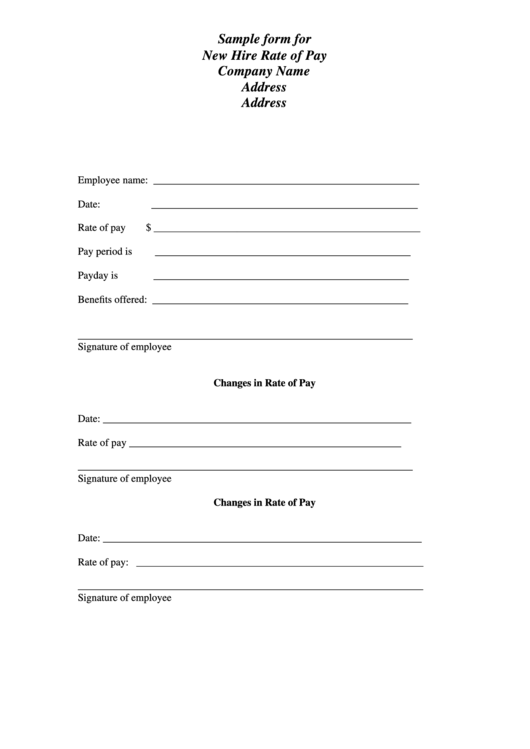

Illinois New Hire Tax Forms – In order to begin withholding fees coming from a new employ, you must complete a New Employ Taxation Kind. The yearly Type W-2 and every quarter payroll taxes filing forms will both involve this taxation variety, which characteristics for your company’s equivalent of a social protection variety. , though the form is not the only one you must submit Moreover, you must file a taxes for the company, which can be tough. Illinois New Hire Tax Forms.

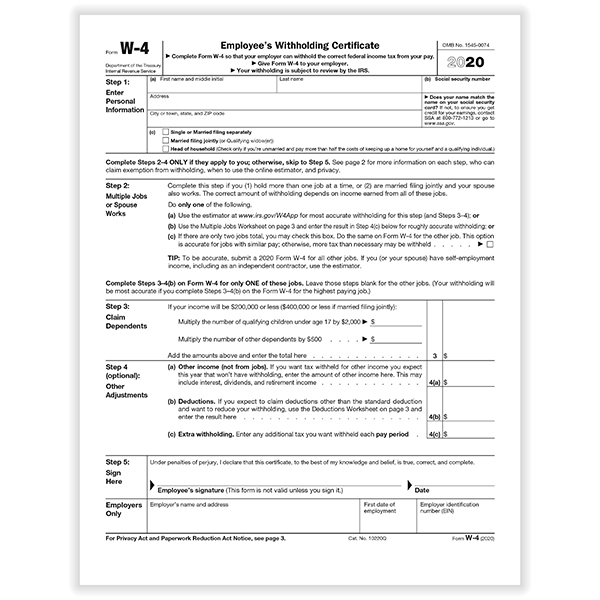

Type W-4

Kind W-4 needs to be filled in by new hires as part of the documentation required for onboarding and new hires. This particular type must be submitted to the state directories and is also needed for four years. If they are not required to file it with the IRS, employers must keep this form on hand for this time period even. If you’re unsure whether you need to file the form, you can check your state’s directory matrix. If you’re wondering whether you must submit a Form W-4 for new hire tax form, you should speak with a qualified accountant to ensure your form is submitted correctly.

Yourwages and dependents, and also other specifics will likely be required in the type. You are not want to calculate allowances on the new kind. As an alternative, you will end up required to determine your career standing, the volume of dependents you might have, as well as any more earnings you could have. Make careful to let your workplace know if you’ve married someone new. To the avoidance associated with a taxation liens or penalty charges, be sure your brand-new Develop W-4 is up to particular date.

important information

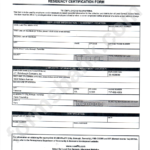

New hires must complete a number of forms, before beginning employment. To ensure that the business to be conformity together with the appropriate laws, these types will probably be submitted to the state federal government. On this page, you’ll uncover some essential essentials and also the overall aim of the kinds. Furthermore, you’ll discover how to finish off them. You can precisely and appropriate total the latest employ income tax kind with the assistance of this article. Comply with these directions to protect yourself from penalties for late submitting and to actually abide with all the law’s requirements.

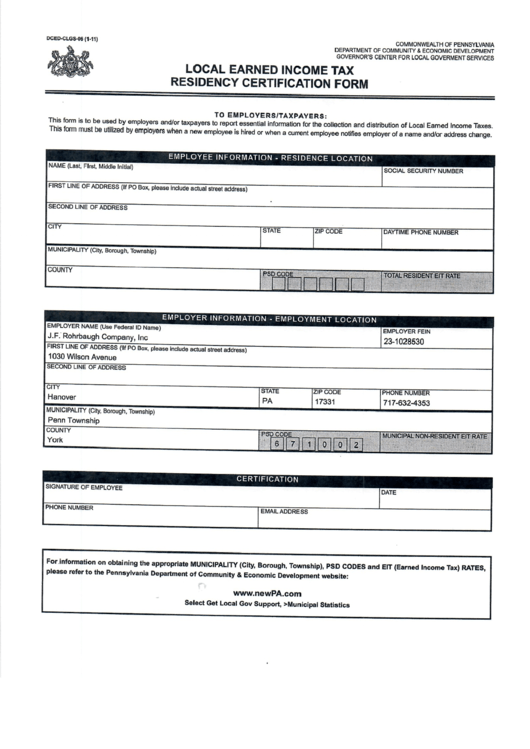

You should receive distinct information and facts in the new employ before finishing the newest retain the services of taxation develop. The employee’saddress and name, social protection variety, and begin date are generally essential. You’ll need to find out the latest employee’s title as well as whether or not they are allowed to job in america. You can use the online system of the Social Security Administration to confirm their identity if they’re hesitant.

Needs

The Requirements for New Hire Tax Form must be finished and submitted, before the start of employment. The IRS stipulates this develop be employed to determine the amount of national income taxes that need to be subtracted through the boss in the pay out of the latest hires. The employee may total the shape or increase it with more details. Before the first paycheck period, the new W-4 forms must be used by the employer.

Making sure a new hire’s right to be effective in the US is the first task inside the employing process. This necessitates many different documents that will verify the potential employee’s detection and illustrate their eligibility for job. New employees also needs to submit a task application, consisting of verifiable information and facts and statements that need to be agreed upon. Before recruiting a new employee, the company must confirm that they have the necessary documentation.

Document-by days

The IRS may be making it more challenging for you to meet your filing deadlines this year if you’ve just recruited a new employee. Luckily, there are alternatives. For beginners, there is the choice of filing your Kind 8809 in writing or electronically. If you want to file on paper, be aware that you might be eligible for a 30-day extension, nevertheless. To qualify for the deadline extension, you should in electronic format publish your Type 8809 by the due date.

If you are submitting the new hire tax form electronically, you have roughly 20 days to file your first report. The Social Stability number of your brand-new worker needs to be attained before they begin working. You must make sure they have a Social Security number before you can submit your report if they don’t live in the United States. You won’t be able to submit your record minus the employee’s Social security number. Additionally, the Social security number should not be exchanged with a environmentally friendly greeting card or even an ITIN.

needed document (s)

Before their first paycheck is provided, a withholding form must be completed by the new employee. The employee’s marriagestatus and dependents, and voluntary withholding amounts are wanted for this kind. The form is also necessary if the employee will be covered by workers compensation insurance. This kind should be accomplished utilizing a social protection cards. As soon as finished, the newest employee’s info is included with the employer’s data source.

Papers showing a brand new hire’s qualifications to operate in america may also be essential. A birth certification, a qualification of naturalization, or paperwork of long term habitation are types of these data. Tribal information from Indigenous Us groupings can also assist this purpose. In addition, confirming forms is mandated by law. Businesses must submit new employee reports under federal law within 20 days, although state restrictions may specify shorter deadlines. Workers should, for that reason, provide the required document(s) before you start a fresh job at the business.