Tax Forms For New Hire Ny State – So that you can begin withholding income taxes from the new retain the services of, you must complete a New Retain the services of Taxation Type. The yearly Form W-2 and quarterly payroll taxes processing types will the two consist of this taxes variety, which functions as your company’s same as a social protection variety. , though the form is not the only one you must submit Furthermore, you must submit a taxes for your personal business, which can be challenging. Tax Forms For New Hire Ny State.

Develop W-4

Develop W-4 has to be completed by new hires within the forms needed for onboarding and new hires. This particular type needs to be sent to their state databases and is also essential for 4 years. Employers must keep this form on hand for this time period even if they are not required to file it with the IRS. You can check your state’s directory matrix if you’re unsure whether you need to file the form. If you’re wondering whether you must submit a Form W-4 for new hire tax form, you should speak with a qualified accountant to ensure your form is submitted correctly.

Yourwages and dependents, as well as other details will be required on the form. You might be not require to estimate allowances around the new develop. Instead, you will be necessary to determine your career standing, the amount of dependents you might have, as well as any additional revenue you might have. Make careful to let your workplace know if you’ve married someone new. To the avoidance of any taxation liens or charges, ensure your new Develop W-4 is perfectly up to particular date.

information you need

Before beginning employment, new hires must complete a number of forms. To ensure that the business to stay in compliance with all the pertinent laws, these forms will probably be published to their state authorities. In this article, you’ll find out some essential specifics as well as the overall aim in the forms. Furthermore, you’ll find out how to finish off them. It is possible to correctly and well-timed comprehensive the newest retain the services of tax type with the help of this post. Comply with these instructions to prevent penalties for later submitting and to actually abide with the law’s needs.

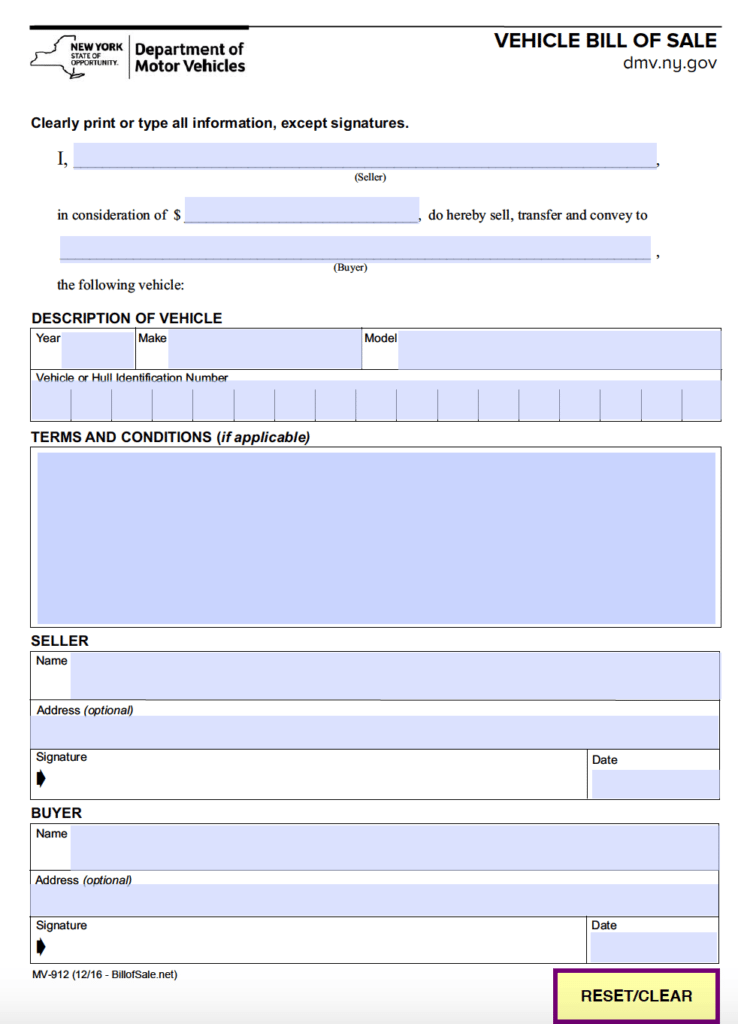

You have to get particular details from your new employ well before doing the newest work with taxation form. The employee’sname and address, societal safety amount, and begin particular date are usually essential. You’ll have to know the new employee’s name as well as whether they are allowed to work in the usa. If they’re hesitant, you can use the online system of the Social Security Administration to confirm their identity.

Requirements

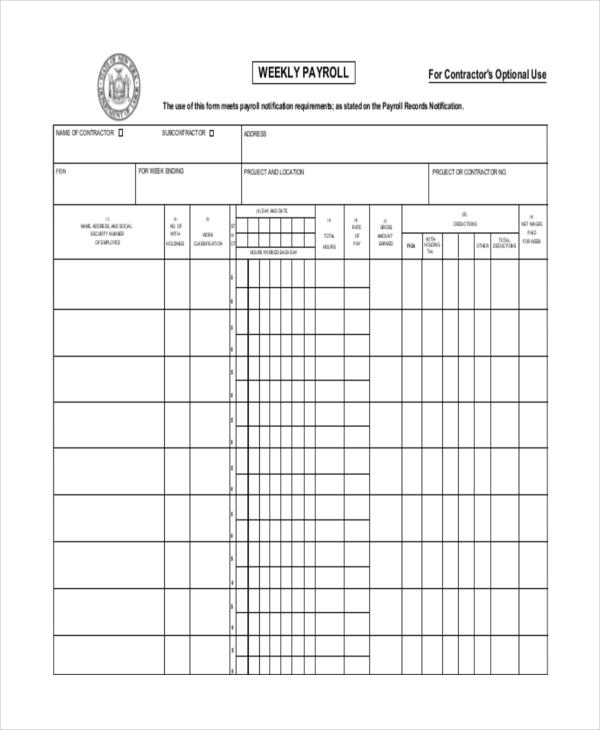

Before the start of employment, the Requirements for New Hire Tax Form must be finished and submitted. The IRS stipulates this form be employed to calculate the amount of government income taxes that really must be deducted through the company from your pay of the latest hires. The worker could total the shape or boost it with added information. Before the first paycheck period, the new W-4 forms must be used by the employer.

Making sure a whole new hire’s legal right to work in the united states is the first step in the selecting procedure. This necessitates many different files that will confirm the prospective employee’s identification and show their qualifications for career. New employees also needs to publish a task form, consisting of established information and facts and assertions that must be signed. Before recruiting a new employee, the company must confirm that they have the necessary documentation.

File-by times

If you’ve just recruited a new employee, the IRS may be making it more challenging for you to meet your filing deadlines this year. The good news is, there are actually options. First of all, there is the choice of filing your Type 8809 on paper or electronically. If you want to file on paper, be aware that you might be eligible for a 30-day extension, nevertheless. To be eligible for the timeline extension, you must digitally distribute your Develop 8809 through the deadline.

If you are submitting the new hire tax form electronically, you have roughly 20 days to file your first report. The Societal Protection number of your employee ought to be attained well before they begin working. If they don’t live in the United States, you must make sure they have a Social Security number before you can submit your report. You won’t be able to distribute your document without having the employee’s Social security number. Furthermore, the SSN can not be replaced by a natural cards or an ITIN.

needed document (s)

A withholding form must be completed by the new employee before their first paycheck is provided. The employee’s maritaldependents and status, and voluntary withholding amounts are typical requested with this develop. The form is also necessary if the employee will be covered by workers compensation insurance. This particular type should be finished utilizing a societal protection greeting card. After concluded, the newest employee’s information is included with the employer’s data bank.

Documents showing a whole new hire’s eligibility to be effective in the usa will also be necessary. A birth official document, a certificate of naturalization, or documentation of long-term habitation are instances of these information. Tribal documents from Native Us groups may also provide this purpose. Moreover, reporting paperwork is mandated legally. Businesses must submit new employee reports under federal law within 20 days, although state restrictions may specify shorter deadlines. Workers should, therefore, give you the required papers(s) prior to starting a fresh job at the firm.