Federal Employee New Hire Forms – You need to complete a New Work with Worker Kind when you start doing work for a fresh organization. Your contact details for crisis situations is also provided on this form, which you should maintain within your employee workers data file. If your employer offers any kind of employee benefit program, additionally, you might need to complete and sign an Employee Benefits Form. Rewards varieties for employees might include anything from disability insurance coverage to reality insurance coverage. A whole new employee’s signature about this document will also be essential for a pension program. Federal Employee New Hire Forms.

Kind W-4

The Shape W-4 should be updated every time a staff member movements work or experiences a modification of conditions. When taxes are filed early in the year, the IRS can withhold a smaller sum of money; however, if too much is withheld early in the year, the employee might owe a sizable number of money in April. Fees and penalties and curiosity will be included in the extra taxation they would owe. As a result, it’s critical that the employee complete Form W-4 as soon as possible.

An agreed-after area of the employee’s payment should be withheld by the workplace for FICA and income taxes. The proper income tax authority is provided with this withheld and after that it is deposited. This form need to also be used to notify their state directory of the latest work with staff. As an employer, you must ensure that the W-4 is not unlawfully changed. You must always remind your staff to update their Form W-4 by December 1 of each year, because of this.

Develop I-9

It is crucial to the company to effectively finish a Kind I-9 and gather the required evidence to confirm the worker’s identification and eligibility for employment when enrolling a fresh staff. Before hiring the applicant, the employer should ensure the accuracy of the document list. The recommendations for the Type I-9 will advise you which documents to request and what to foresee when publishing the requested files. Three standard databases are typically included about the kinds. The documents necessary to demonstrate the employee’s identification and eligibility for work are listed in Checklist A.

Kind I-9 papers should be kept to get a set timeframe soon after a member of staff is employed and must be available to approved personnel. The Department of Homeland Stability, the Department of Labour, and also the Department of Justice’s Immigrant and Worker Proper rights Segment are among these accepted organizations. You might need to change the form or go without it fully dependant upon what your location is located. You can access an educational webinar if you have inquiries about Form I-9 compliance, by registering for the HRCI or SHRM.

job agreement

It’s essential to discover labor restrictions when working with new staff as well as keep these things indication a binding agreement. The specifics of the career ought to be stipulated from the work agreement for a fresh retain the services of personnel. It ought to include information regarding the employee’s pay, hours proved helpful, rewards, and carry options. Positive aspects like 401(k) complementing, medical health insurance, dental treatments, commuter rewards, and paid out time off of for family ought to be incorporated. This clause should be inserted in the contract if the employee will get certain benefits during their employment.

However, not exclusive, an work agreement does include substantial info. The beginning day, begin time, kind of work, and if the worker is going to be allowed to get business from your Employer’s clientele need to be evidently stated within the contract. The completion day and the chance of an extension also need to be provided. An employee should always request a copy of the employment contract, before signing anything. Last but not least, a non-contend clause and a half a dozen-month notice time soon after termination needs to be incorporated into an work agreement.

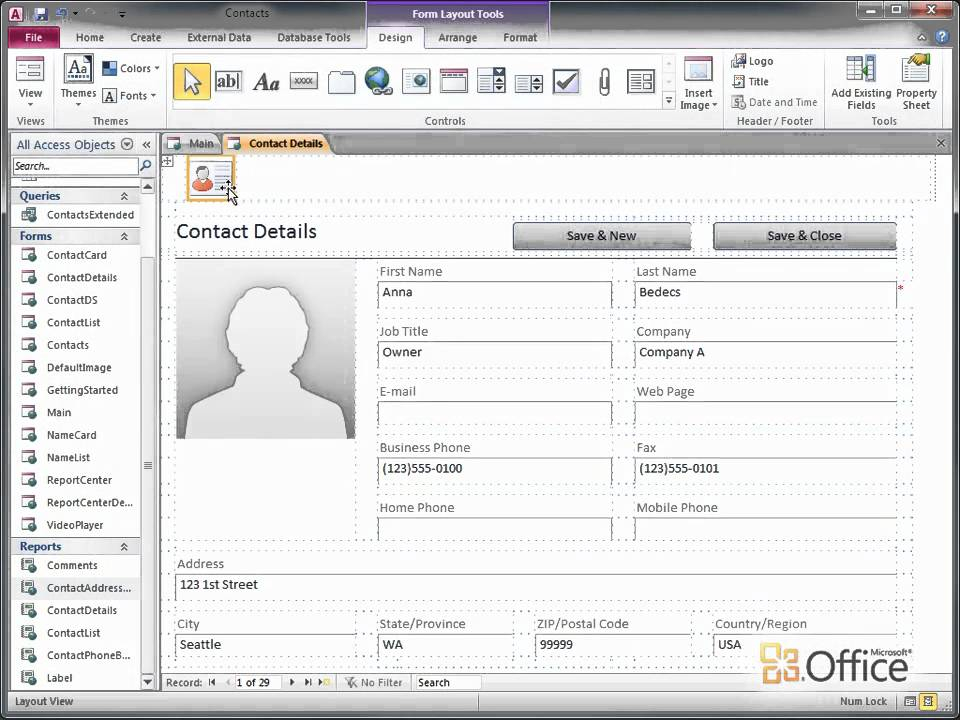

Type for immediate deposit

A Primary Downpayment Type must be provided to each new hiring you are making. This record allows the transfer of cash from your employee’s banking accounts and contains information regarding straight deposit. The worker will probably be encouraged to deliver information, banking account info, and crisis contact information. It ought to be presented to the brand new employee in the secure region. If you use an outside payroll agency, you can transmit the form electronically.

Make how the form has very clear directions. Alternatives like selecting the most practical time to down payment a splitting and check paychecks should be incorporated into these directions. It should also include consents to send the employee’s salary into numerous accounts. The authorization from the staff to produce these deposit should also be explained about the develop. It ought to also establish as soon as the payments are required to get created. The shape should also include positive affirmations to minimize the employer’s culpability.

acknowledgment develop for your worker handbook

An employee manual acknowledgement kind must be shipped to new hires at the start of their career with the enterprise. It will probably be mentioned in the form that the personnel has comprehended and read the manual. The shape will even take note that it is the employee’s accountability to comprehend and read the handbook, how the personnel is familiar with the insurance policies, which the employee believes to comply with them. The guide book must also make very clear that adjustments could be created at any time. The staff member manual will also have an effective date, a revision or variation number, along with a document that this model swithces all of the other iterations. In addition, there ought to be room in the type for that employee’s name and trademark.

All staff ought to be required to complete the worker manual acknowledgement kind. If they refuse to sign the paperwork, although the employee may not be a suitable fit for the business. Other choices are available if that is the case. The HR expert can create a notation on the develop showing the employee was due to the handbook and informed of its insurance policies rather than requesting these to indicator it.