Illinois New Hire Reporting Form – Pay close attention to the employer when sending a brand new Work with report type. If they hire their own workers, labor groups and hiring halls must file these reports. However, short-term job organizations are exempt from submitting New Retain the services of studies. Here are some pointers if you’re uncertain about your duties: Illinois New Hire Reporting Form.

Company

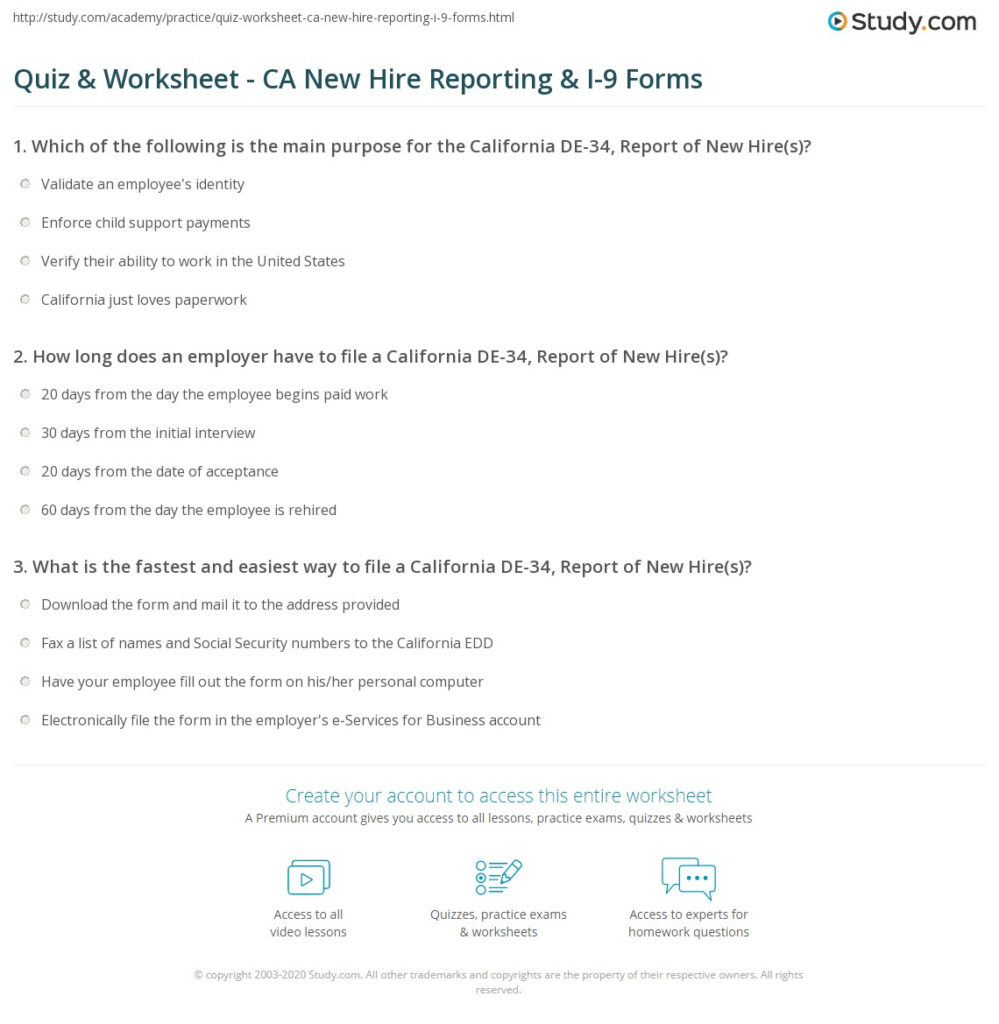

National regulation mandates a new hire statement be submitted within 20 events of the employee’s employment particular date. Firms are still required to abide with these laws, even though state regulations may set shorter deadlines for reporting new hires. Even though some claims permit organizations to formulate a substitute develop, firms need to document new hire studies using the W4 form. New work with reporting should be mailed electronically to guarantee concurrence. These assistance will help you in sticking with the brand new Work with Confirming guidelines.

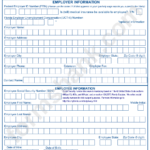

The New Hire Report form is simple and quick to complete, but there are a few things you should keep in mind. The form is within Adobe Pdf file format, you need to perspective by downloading a totally free backup of Adobe Acrobat Reader. When Adobe Acrobat Readers has been acquired, you could possibly swiftly complete the new employ report develop. To publish the desired reviews on the Department of Labor, you should utilize this kind.

Information that should be reported

Businesses are necessary for legislation to document new using the services of info under the Personal Work and Responsibility Possibility Reconciliation Work (PRWORA) of 1996. The state social support plans and, especially, new work with revealing, were actually tremendously impacted by this reform. Enterprises are required to distribute individual identification info for freshly appointed workers. Each state has its own unique set of reporting obligations, however. However, PRWORA’s standards for reporting new hire data are straightforward, understandable, and uncomplicated.

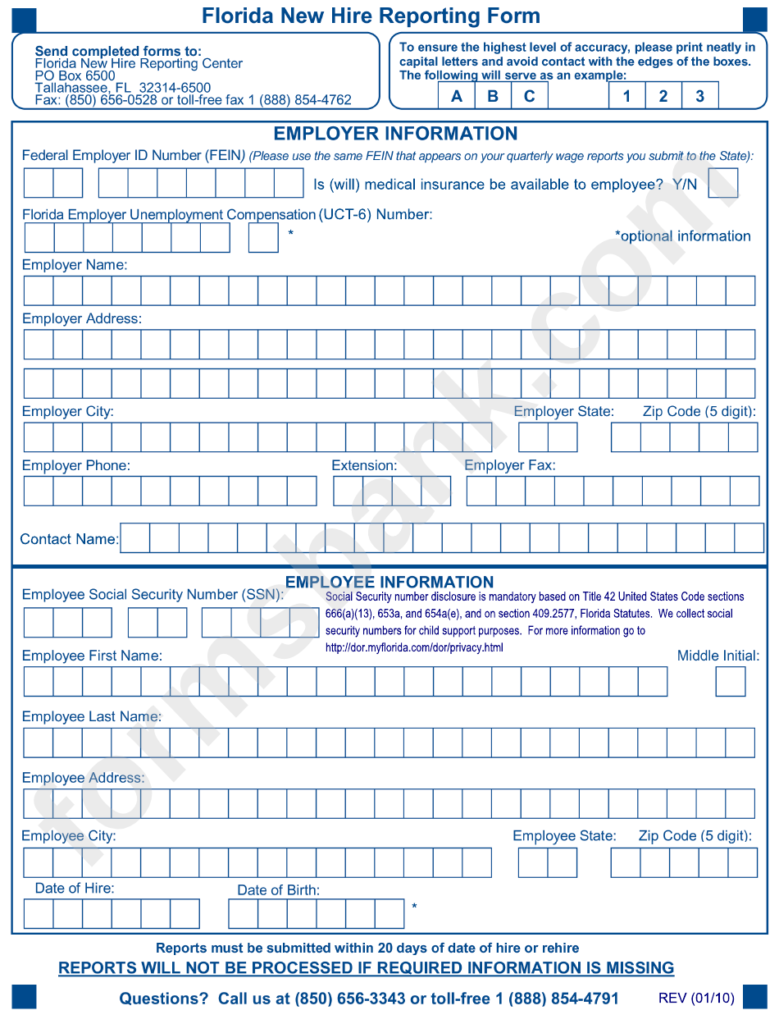

The date the individual was appointed as being a new staff should be claimed through the employer. The Time of Hire is yet another term for this. The employer is necessary to disclose the date of the most recent work with when an employee is rehired from the very same enterprise. The employee’s Social Security quantity as well as the particular date which they first started providing paid back services may also be needed around the report type. The business must submit the new hire report form to the Department of Labor and Work Opportunity Reconciliation, by the conclusion of the first month following the employment of a new employee.

firm of condition to become knowledgeable

Both the government along with the states in which a individual performs will need new employ records. This legislation mandates that companies tell the State company where worker exists or works of the new hires. An internet, faxed, or sent by mail version of any new work with report develop can be obtained. Typically, three business days after an employee’s start date, the company must report them. Each new personnel must fill in the shape and give it to the Division of Work.

National rules mandates that organizations give you the condition authorities with new hire info in 20 times of the employee’s career time, while many says have smaller revealing demands. According to state-specific regulations, employers must utilize the W-4 form or a comparable form for this purpose. Employers must follow the days for confirming new hires, no matter the approach employed. If an employee leaves before the deadline, the employer is still required to record earnings earned during the working relationship even.

processing timeline

A new hire report form may be sent to the state on or before the due date. This type can be a PDF submit produced by Adobe. By selecting the Adobe icon, the software can be downloaded for nothing. If you don’t feel comfortable filling it out on a computer, you can print the form from your computer. Ensure the form is totally loaded out and that all the information is understandable. You must detain your employee if they don’t have a Social Security number until they can supply one.

Be sure to submit the form promptly to protect yourself from paying a great or facing legal action. Every single status carries a distinct date for submitting a new employ document. In the state of California, the filing timeline is December 31. You need to submit a new employ statement for each worker you sign up who may have a minimum of two months of previous work experience in just a 7 days of their start day. If the person has been employed for 60 days but was only recently hired, alternatively, you must submit a new hire report form.