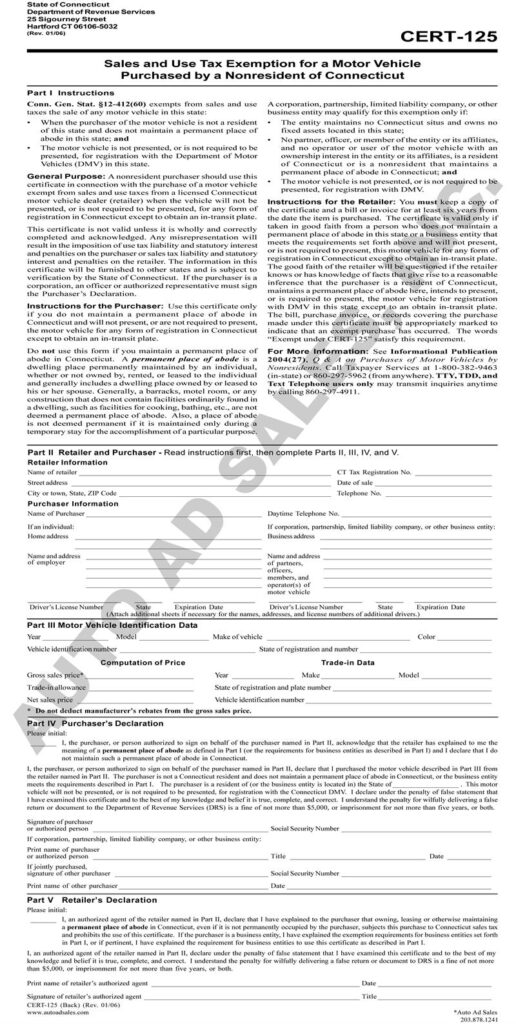

New Hire State Tax Forms Connecticut – In order to begin withholding taxes coming from a new hire, you need to finish a New Hire Taxes Kind. The annually Type W-2 and every quarter payroll tax filing kinds will both consist of this taxes amount, which features as your company’s same as a interpersonal protection amount. , though the form is not the only one you must submit In addition, you need to submit a taxes for your personal organization, which can be demanding. New Hire State Tax Forms Connecticut.

Type W-4

Kind W-4 has to be completed by new hires as part of the forms needed for onboarding and new hires. This particular type must be published to the state databases and it is required for 4 years. Employers must keep this form on hand for this time period even if they are not required to file it with the IRS. If you’re unsure whether you need to file the form, you can check your state’s directory matrix. If you’re wondering whether you must submit a Form W-4 for new hire tax form, you should speak with a qualified accountant to ensure your form is submitted correctly.

Yourdependents and wages, and other particulars is going to be asked for on the type. You happen to be not want to determine allowances on the new form. Instead, you will certainly be necessary to identify your career standing, the quantity of dependents you may have, and any further cash flow you may have. If you’ve married someone new, make careful to let your workplace know. For that avoidance of any taxation liens or penalties, ensure your Kind W-4 is perfectly up to time.

important information

New hires must complete a number of forms, before beginning employment. To ensure that the employer to stay in conformity using the related regulations, these varieties is going to be sent to their state federal government. Right here, you’ll learn some significant specifics along with the overall goal of the types. Furthermore, you’ll learn how to complete them. You are able to correctly and well-timed complete the latest work with taxes form with the assistance of this short article. Stick to these instructions to avoid charges for past due submission and to make sure you abide with all the law’s specifications.

You must receive specific details through the new retain the services of before accomplishing the brand new retain the services of tax kind. The employee’sname and address, societal stability variety, and commence particular date are generally needed. You’ll must know the new employee’s name together with whether or not they are capable of work in the states. If they’re hesitant, you can use the online system of the Social Security Administration to confirm their identity.

Requirements

Before the start of employment, the Requirements for New Hire Tax Form must be finished and submitted. The Internal Revenue Service stipulates that it kind be employed to determine the volume of government income taxes that must definitely be subtracted through the company from your shell out of brand new hires. The staff member could complete the shape or increase it with more specifics. The new W-4 forms must be used by the employer before the first paycheck period.

Making sure a fresh hire’s right to function in the US is the first task within the hiring process. This necessitates various papers that can attest to the potential employee’s recognition and illustrate their eligibility for job. New staff members must also publish work application form, consisting of established details and statements that must definitely be agreed upon. Before recruiting a new employee, the company must confirm that they have the necessary documentation.

Submit-by times

If you’ve just recruited a new employee, the IRS may be making it more challenging for you to meet your filing deadlines this year. The good news is, you will find selections. For beginners, you will find the use of declaring your Type 8809 on paper or electronically. Nevertheless, if you want to file on paper, be aware that you might be eligible for a 30-day extension. To qualify for the due date extension, you must in electronic format submit your Kind 8809 with the due date.

If you are submitting the new hire tax form electronically, you have roughly 20 days to file your first report. The Sociable Protection number of your new worker ought to be attained just before they begin operating. If they don’t live in the United States, you must make sure they have a Social Security number before you can submit your report. You won’t have the ability to distribute your statement minus the employee’s Social security number. Additionally, the Social security number cannot be changed with a eco-friendly credit card or perhaps an ITIN.

required document (s)

Before their first paycheck is provided, a withholding form must be completed by the new employee. The employee’s maritaldependents and status, and voluntary withholding amounts are common required with this type. If the employee will be covered by workers compensation insurance, the form is also necessary. This particular type might need to be finished utilizing a sociable protection credit card. As soon as done, the brand new employee’s details are included with the employer’s database.

Files exhibiting a whole new hire’s qualifications to operate in the US are also required. A arrival certification, a certification of naturalization, or documents of long term habitation are instances of these records. Tribal documents from Local United states groups may also assist this purpose. In addition, reporting documents is required by law. Businesses must submit new employee reports under federal law within 20 days, although state restrictions may specify shorter deadlines. Staff members have to, for that reason, give you the necessary papers(s) before starting a fresh career in a company.