New Hire Tax Reporting Form 2022 Wisconsin – Be aware of the employer when submitting a fresh Retain the services of report form. If they hire their own workers, labor groups and hiring halls must file these reports. However, short-term job organizations are exempt from sending New Employ records. Here are some pointers if you’re uncertain about your duties: New Hire Tax Reporting Form 2022 Wisconsin.

Company

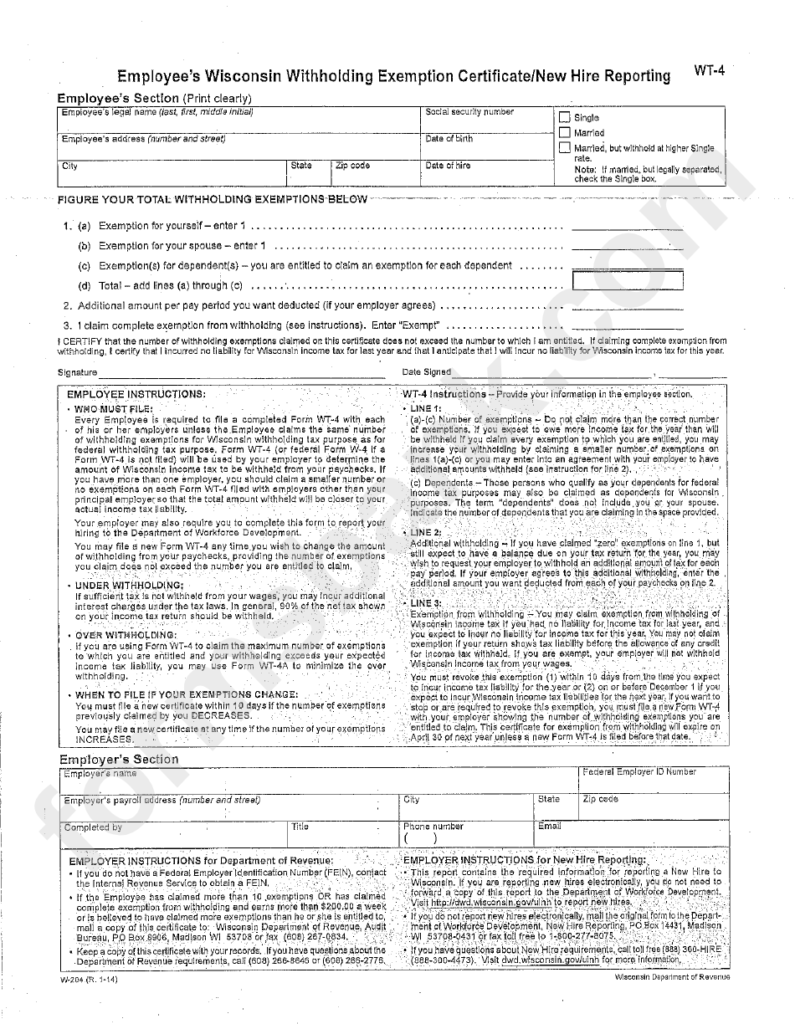

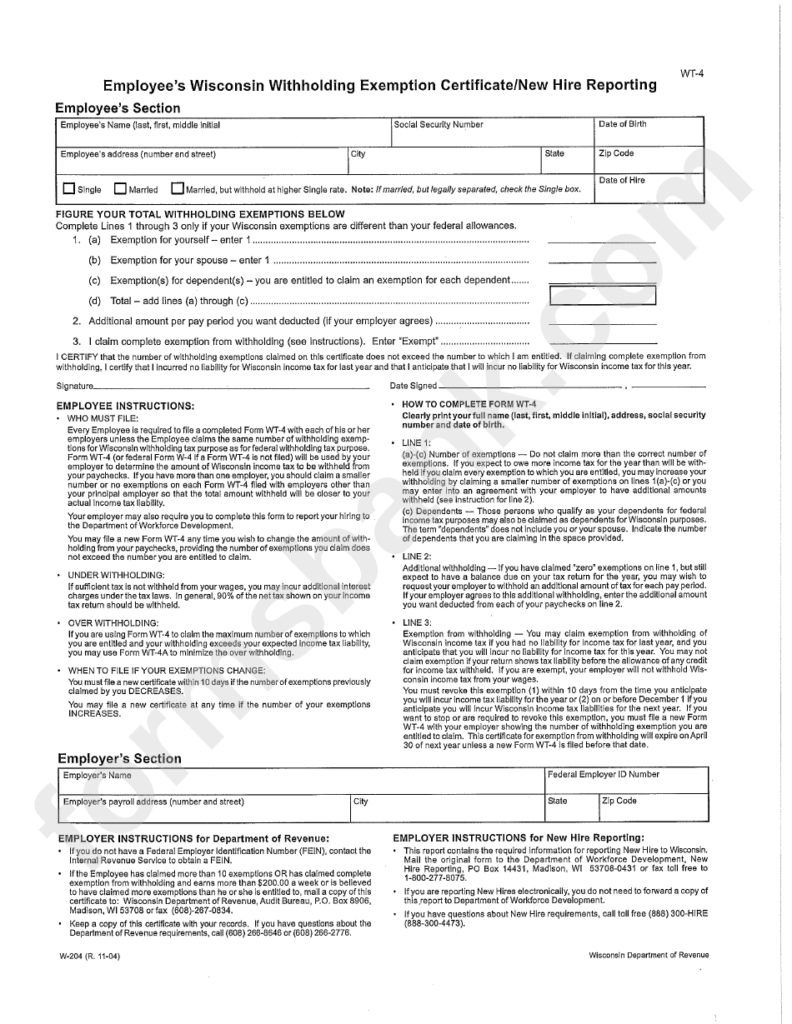

Government regulation mandates which a new work with document be submitted within 20 days of the employee’s work particular date. Firms are still required to abide with these laws, even though state regulations may set shorter deadlines for reporting new hires. Although some claims allow companies to produce a substitute form, businesses need to file new work with studies making use of the W4 form. New employ revealing needs to be mailed electronically to assure compliance. The following assistance will help you in sticking with the newest Employ Reporting guidelines.

The New Hire Report form is quick and simple to complete, but there are a few things you should keep in mind. The shape is within Adobe PDF structure, which you should see by getting a free copy of Adobe Acrobat Viewer. As soon as Adobe Acrobat Readers is delivered electronically, you could rapidly complete the newest retain the services of record develop. To submit the required records on the Division of Labour, you should use this kind.

Specifics that ought to be documented

Businesses are required by rules to history new selecting information and facts beneath the Personal Responsibility and Work Chance Reconciliation Act (PRWORA) of 1996. The state societal assistance plans and, specifically, new work with confirming, were tremendously impacted by this reform. Enterprises are required to publish personal identity data for newly appointed personnel. Each state has its own unique set of reporting obligations, however. PRWORA’s standards for reporting new hire data are straightforward, understandable, and uncomplicated.

The time the individual was chosen being a new worker must be claimed with the workplace. The Day of Retain the services of is another name for this. The business is needed to make known the time of the more current retain the services of when a staff member is rehired from the very same business. The employee’s Interpersonal Security amount as well as the time that they initial began supplying paid for professional services will also be needed in the document kind. By the conclusion of the first month following the employment of a new employee, the business must submit the new hire report form to the Department of Labor and Work Opportunity Reconciliation.

firm of condition being informed

The two the federal government along with the suggests when a particular person operates will need new employ records. This legislation mandates that employers alert the State firm where the staff exists or operates for any new hires. An online, faxed, or sent by mail version of a new work with statement develop can be obtained. Typically, three business days after an employee’s start date, the company must report them. Every new worker must fill in the shape and give it on the Department of Labor.

Federal legislation mandates that organizations supply the state federal government with new work with info inside 20 events of the employee’s work particular date, although some says have quicker reporting specifications. Employers must utilize the W-4 form or a comparable form for this purpose, according to state-specific regulations. Employers need to follow the days for reporting new hires, regardless of the method employed. The employer is still required to record earnings earned during the working relationship even if an employee leaves before the deadline.

declaring time frame

Before the due date, a new hire report form may be sent to the state on or. This kind can be a PDF file developed by Adobe. The software can be downloaded for nothing, by selecting the Adobe icon. If you don’t feel comfortable filling it out on a computer, you can print the form from your computer. Ensure the type is completely packed out and that all of the information is understandable. You must detain your employee if they don’t have a Social Security number until they can supply one.

Make sure to publish the shape punctually to avoid paying out a great or dealing with legal action. Every single status has a various day for posting a whole new employ document. In the condition of Ca, the declaring time frame is December 31. You must send a whole new employ document for every employee you bring in having no less than 60 days of prior experience within a full week of their commence day. Alternatively, you must submit a new hire report form if the person has been employed for 60 days but was only recently hired.