New Hire Tax Reporting Form 2023 Wisconsin – Pay attention to the employer when publishing a New Employ record form. If they hire their own workers, labor groups and hiring halls must file these reports. On the flip side, momentary career companies are exempt from posting New Hire records. Here are some pointers if you’re uncertain about your duties: New Hire Tax Reporting Form 2023 Wisconsin.

Employer

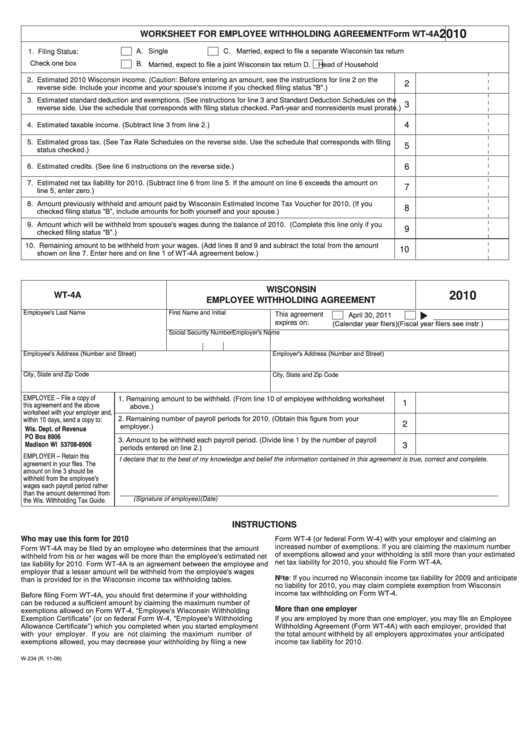

National rules mandates that a new retain the services of document be submitted in 20 times of the employee’s employment date. State regulations may set shorter deadlines for reporting new hires, but firms are still required to abide with these laws. Even though some suggests permit businesses to develop an alternative kind, firms must submit new retain the services of studies while using W4 kind. New work with revealing ought to be sent electronically to ensure conformity. These guidance will assist you in implementing the brand new Employ Reporting legislation.

There are a few things you should keep in mind, although the New Hire Report form is simple and quick to complete. The form is within Adobe Pdf file format, that you simply should look at by getting a free of charge backup of Adobe Acrobat Reader. Once Adobe Acrobat Viewer is acquired, you could possibly rapidly complete the latest retain the services of statement type. To distribute the specified reviews to the Division of Work, you have to make use of this kind.

Specifics that ought to be reported

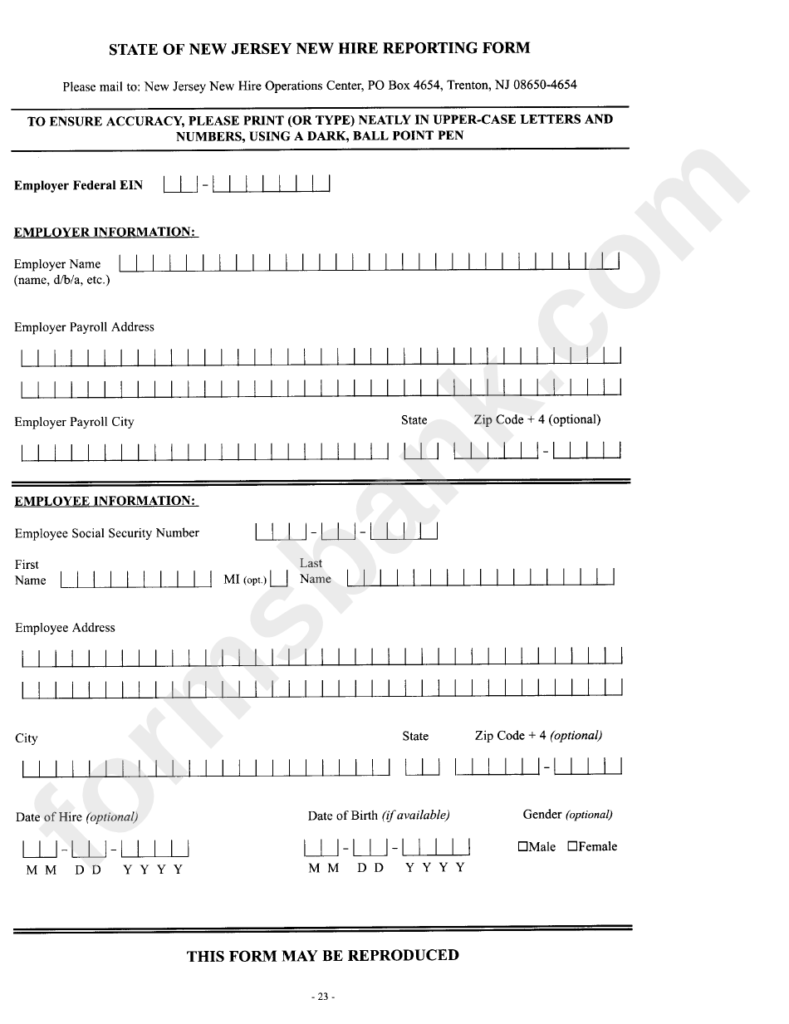

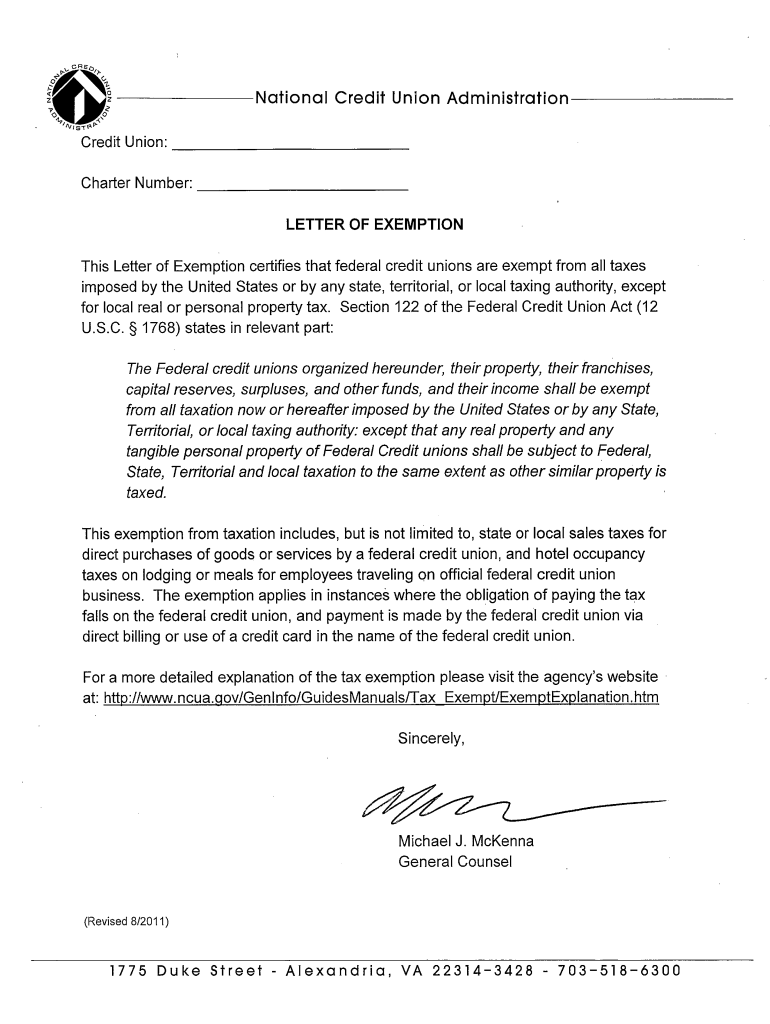

Businesses are necessary for legislation to report new using the services of information under the Personalized Responsibility and Work Possibility Reconciliation Respond (PRWORA) of 1996. Their state interpersonal support applications and, especially, new retain the services of confirming, were tremendously impacted by this change. Organizations have to submit personalized identification data for newly hired employees. Each state has its own unique set of reporting obligations, however. PRWORA’s standards for reporting new hire data are straightforward, understandable, and uncomplicated.

The date a person was employed being a new employee should be claimed from the employer. The Day of Employ is an additional reputation for this. The business is necessary to make known the particular date of the very the latest retain the services of when a worker is rehired in the identical enterprise. The employee’s Social Security variety and the time they initial started delivering paid for professional services will also be required on the record kind. The business must submit the new hire report form to the Department of Labor and Work Opportunity Reconciliation, by the conclusion of the first month following the employment of a new employee.

agency of status being educated

Equally the federal government as well as the suggests in which a person works require new work with reports. This legislation mandates that businesses notify the State company where the staff exists or performs of any new hires. An internet, faxed, or mailed backup of your new retain the services of statement form is offered. Three business days after an employee’s start date, the company must report them. Every single new staff have to complete the form and send it on the Office of Labour.

Government rules mandates that firms supply the condition govt with new hire information inside 20 times of the employee’s work time, although some states have shorter revealing needs. According to state-specific regulations, employers must utilize the W-4 form or a comparable form for this purpose. Companies have to adhere to the times for revealing new hires, whatever the approach utilized. The employer is still required to record earnings earned during the working relationship even if an employee leaves before the deadline.

submitting time frame

A new hire report form may be sent to the state on or before the due date. This type is actually a Pdf file data file created by Adobe. By selecting the Adobe icon, the software can be downloaded for nothing. You can print the form from your computer if you don’t feel comfortable filling it out on a computer. Ensure that the type is utterly packed out and that each of the facts are readable. You must detain your employee if they don’t have a Social Security number until they can supply one.

Be sure to distribute the shape on time to prevent spending an excellent or facing legal action. Each and every state features a diverse date for sending a brand new hire report. In the condition of California, the filing due date is Dec 31. You need to submit a new work with report for each employee you sign up having no less than two months of preceding work experience in a few days with their begin day. If the person has been employed for 60 days but was only recently hired, alternatively, you must submit a new hire report form.