Pa Tax Forms New Hire – To be able to get started withholding income taxes from your new employ, you need to complete a New Retain the services of Income tax Form. The yearly Develop W-2 and every quarter payroll taxation submitting types will both incorporate this taxation quantity, which capabilities as the company’s equivalent of a societal protection variety. , though the form is not the only one you must submit In addition, you should document a tax return for your company, which might be challenging. Pa Tax Forms New Hire.

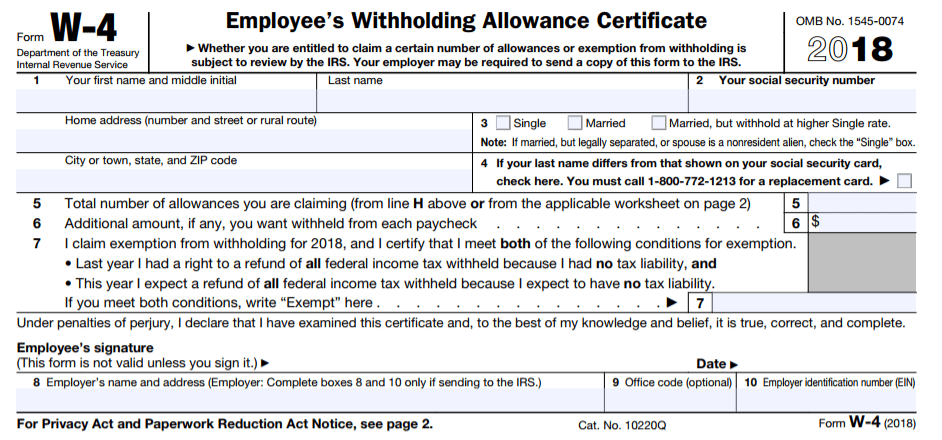

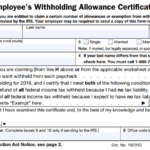

Kind W-4

Develop W-4 needs to be filled out by new hires in the documents needed for onboarding and new hires. This particular type must be published to their state internet directories and it is required for four years. Employers must keep this form on hand for this time period even if they are not required to file it with the IRS. If you’re unsure whether you need to file the form, you can check your state’s directory matrix. You should speak with a qualified accountant to ensure your form is submitted correctly if you’re wondering whether you must submit a Form W-4 for new hire tax form.

Yourdependents and wages, and also other particulars will likely be requested in the kind. You are not need to determine allowances in the new kind. Instead, you will certainly be needed to determine your career position, the quantity of dependents you possess, as well as additional income maybe you have. If you’ve married someone new, make careful to let your workplace know. For your avoidance for any taxation liens or charges, be sure your brand-new Develop W-4 is up to time.

information you need

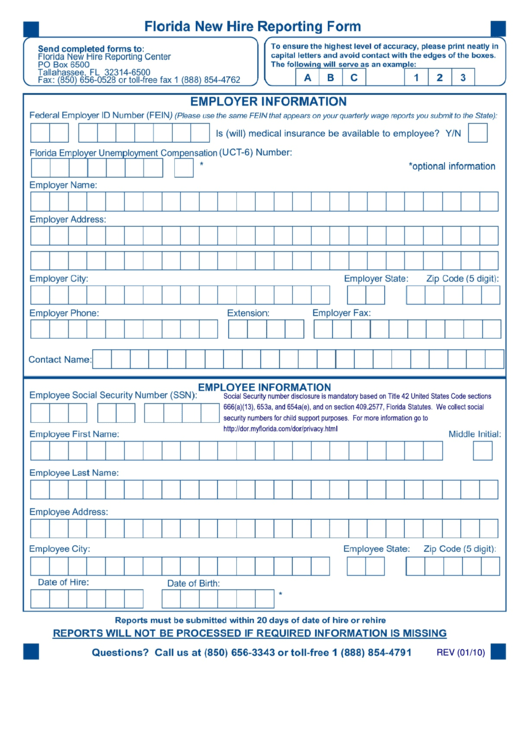

Before beginning employment, new hires must complete a number of forms. In order for the employer to remain concurrence with all the pertinent laws and regulations, these kinds is going to be sent to the state federal government. Here, you’ll find out some significant details and also the all round objective of your types. In addition, you’ll discover how to finish them. It is possible to accurately and prompt total the newest hire income tax kind with the assistance of this article. Follow these recommendations in order to avoid fees and penalties for later submission and to ensure that you abide together with the law’s needs.

You need to receive specific info through the new work with well before accomplishing the brand new retain the services of taxation form. The employee’sname and address, societal stability number, and begin time are typically necessary. You’ll have to know the newest employee’s label in addition to whether or not they are qualified to job in america. You can use the online system of the Social Security Administration to confirm their identity if they’re hesitant.

Requirements

The Requirements for New Hire Tax Form must be finished and submitted, before the start of employment. The Internal Revenue Service stipulates this develop be used to estimate the level of federal income taxes that really must be subtracted with the company in the spend of new hires. The employee might full the shape or add to it with extra details. The new W-4 forms must be used by the employer before the first paycheck period.

Verifying a new hire’s legal right to work in the usa is the first step inside the using the services of approach. This necessitates a number of paperwork that can verify the potential employee’s identification and illustrate their qualifications for employment. New employees also must send a job form, including verifiable information and statements that must definitely be agreed upon. Before recruiting a new employee, the company must confirm that they have the necessary documentation.

Data file-by schedules

The IRS may be making it more challenging for you to meet your filing deadlines this year if you’ve just recruited a new employee. Thankfully, you can find selections. First of all, you have the option of declaring your Develop 8809 on paper or digitally. If you want to file on paper, be aware that you might be eligible for a 30-day extension, nevertheless. To qualify for the timeline extension, you need to in electronic format send your Develop 8809 with the deadline.

You have roughly 20 days to file your first report if you are submitting the new hire tax form electronically. The Sociable Stability quantity of your brand-new personnel must be acquired prior to they begin operating. If they don’t live in the United States, you must make sure they have a Social Security number before you can submit your report. You won’t be capable of submit your report without having the employee’s Social security number. Additionally, the SSN should not be substituted by a environmentally friendly credit card or even an ITIN.

required papers (s)

A withholding form must be completed by the new employee before their first paycheck is provided. The employee’s marriagedependents and status, and voluntary withholding sums are common required on this type. The form is also necessary if the employee will be covered by workers compensation insurance. This kind should be accomplished utilizing a sociable protection greeting card. As soon as concluded, the new employee’s information is put into the employer’s data base.

Paperwork exhibiting a fresh hire’s eligibility to work in the united states are also required. A birth qualification, a official document of naturalization, or records of long-term habitation are samples of these information. Tribal records from Native American citizen organizations could also provide this purpose. Additionally, revealing documents is required legally. Businesses must submit new employee reports under federal law within 20 days, although state restrictions may specify shorter deadlines. Workers must, therefore, provide you with the necessary file(s) before starting a new task at the business.