Understanding New Hire Tax Forms – To be able to get started withholding fees coming from a new employ, you must complete a New Hire Income tax Form. The every year Type W-2 and quarterly payroll taxes filing types will both include this income tax amount, which capabilities as the company’s same as a interpersonal security amount. , though the form is not the only one you must submit Furthermore, you must submit a tax return for the company, which can be tough. Understanding New Hire Tax Forms.

Type W-4

Develop W-4 has to be filled in by new hires within the paperwork required for onboarding and new hires. This type must be sent to their state internet directories and is also required for four years. Employers must keep this form on hand for this time period even if they are not required to file it with the IRS. You can check your state’s directory matrix if you’re unsure whether you need to file the form. If you’re wondering whether you must submit a Form W-4 for new hire tax form, you should speak with a qualified accountant to ensure your form is submitted correctly.

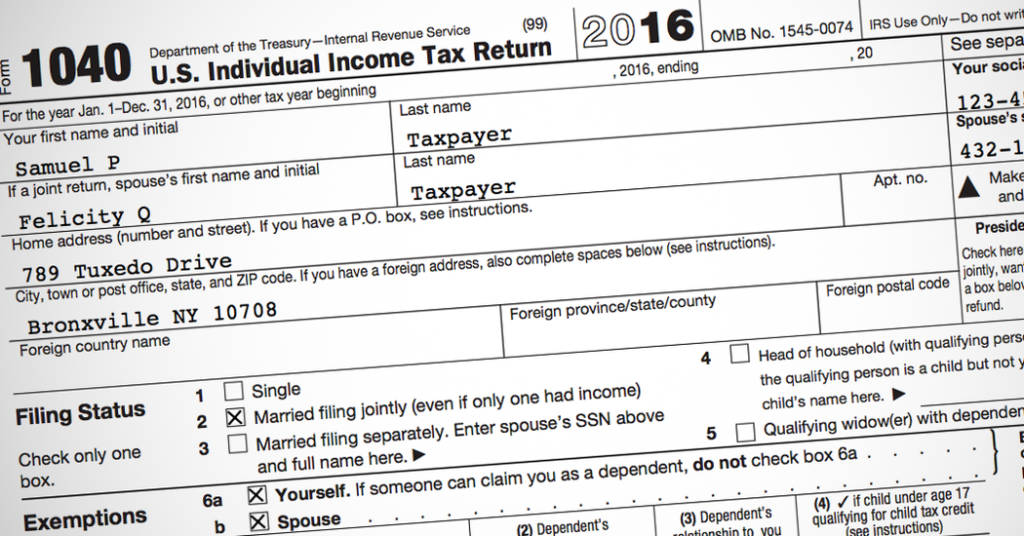

Yourdependents and wages, and other details will be required on the type. You will be not need to compute allowances on the new develop. Rather, you will certainly be expected to recognize your work reputation, the volume of dependents you have, as well as any additional earnings you may have. If you’ve married someone new, make careful to let your workplace know. To the avoidance of any tax liens or fees and penalties, make sure your brand-new Type W-4 is perfectly up to date.

necessary information

Before beginning employment, new hires must complete a number of forms. To ensure the employer to be agreement using the related legal guidelines, these types will probably be submitted to the state federal government. In this article, you’ll discover some important essentials as well as the total aim of the kinds. Additionally, you’ll understand how to complete them. You can correctly and timely total the brand new employ income tax kind with the help of this informative article. Adhere to these recommendations to avoid fees and penalties for delayed distribution and to successfully abide together with the law’s specifications.

You must acquire certain information and facts from the new retain the services of just before completing the latest hire taxes develop. The employee’saddress and name, social security quantity, and begin date are usually required. You’ll need to find out the brand new employee’s name together with whether or not they are capable of operate in the states. If they’re hesitant, you can use the online system of the Social Security Administration to confirm their identity.

Demands

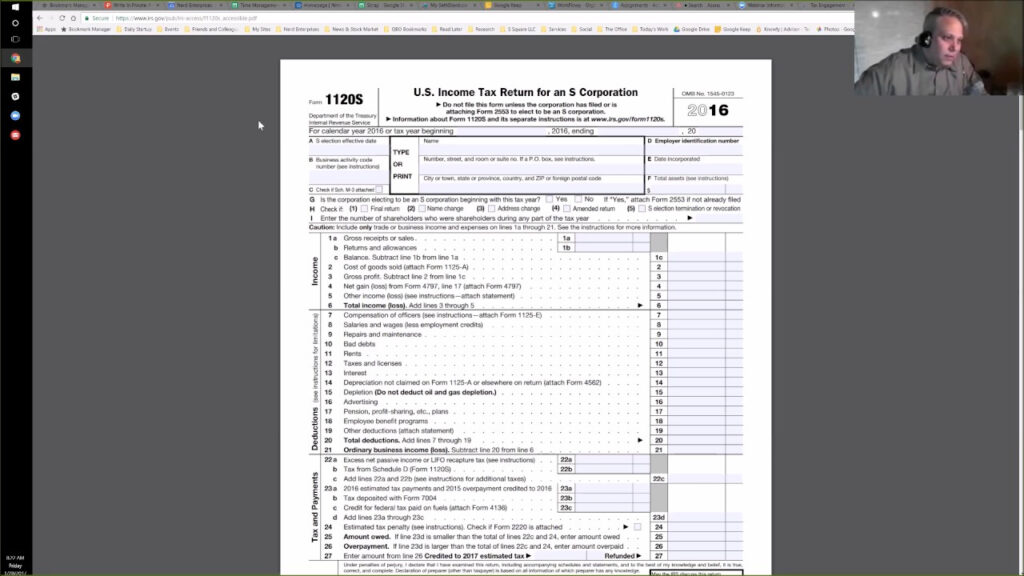

The Requirements for New Hire Tax Form must be finished and submitted, before the start of employment. The IRS stipulates this develop be utilized to compute the amount of national income taxes that must definitely be deducted through the workplace through the pay out of the latest hires. The employee might total the form or enhance it with extra information. The new W-4 forms must be used by the employer before the first paycheck period.

Verifying a new hire’s right to work in the united states is the first step from the using the services of procedure. This necessitates various documents that may confirm the potential employee’s recognition and display their eligibility for job. New staff members also must distribute a job application form, including verifiable info and assertions that must be agreed upon. The company must confirm that they have the necessary documentation, before recruiting a new employee.

Document-by days

If you’ve just recruited a new employee, the IRS may be making it more challenging for you to meet your filing deadlines this year. Thankfully, there are options. For starters, you will have the choice of declaring your Type 8809 in writing or electronically. If you want to file on paper, be aware that you might be eligible for a 30-day extension, nevertheless. To be eligible for the timeline extension, you must digitally send your Kind 8809 with the timeline.

You have roughly 20 days to file your first report if you are submitting the new hire tax form electronically. The Social Stability quantity of your new personnel ought to be obtained prior to they start functioning. If they don’t live in the United States, you must make sure they have a Social Security number before you can submit your report. You won’t have the ability to distribute your statement without the employee’s Social security number. Moreover, the SSN can not be exchanged by a environmentally friendly card or an ITIN.

needed papers (s)

Before their first paycheck is provided, a withholding form must be completed by the new employee. The employee’s marriagestatus and dependents, and voluntary withholding amounts are common requested about this type. If the employee will be covered by workers compensation insurance, the form is also necessary. This kind should be accomplished employing a interpersonal safety credit card. As soon as finished, the latest employee’s info is included with the employer’s data bank.

Papers displaying a whole new hire’s qualifications to operate in the united states are also essential. A delivery qualification, a official document of naturalization, or documentation of long-term habitation are examples of these data. Tribal information from Native United states groupings may also offer this objective. In addition, reporting documentation is required by law. Businesses must submit new employee reports under federal law within 20 days, although state restrictions may specify shorter deadlines. Employees must, consequently, provide you with the essential papers(s) before you start a fresh career at a business.