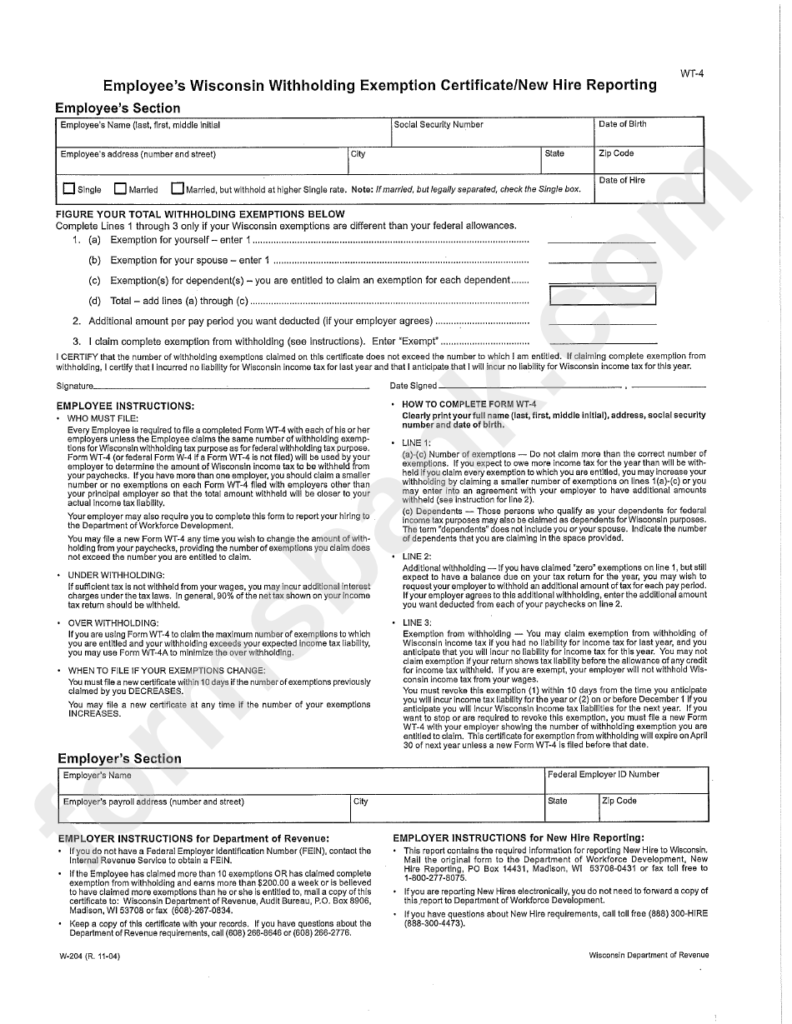

Wisconsin Employee New Hire Withholding Form – You have to complete a New Hire Worker Type when you begin working for a new company. Your contact info for emergencies is additionally integrated about this kind, you should maintain in your staff staff file. If your employer offers any kind of employee benefit program, additionally, you might need to complete and sign an Employee Benefits Form. Advantages varieties for workers could include from impairment insurance policy to reality insurance coverage. A brand new employee’s personal about this document may also be required for a retirement living plan. Wisconsin Employee New Hire Withholding Form.

Form W-4

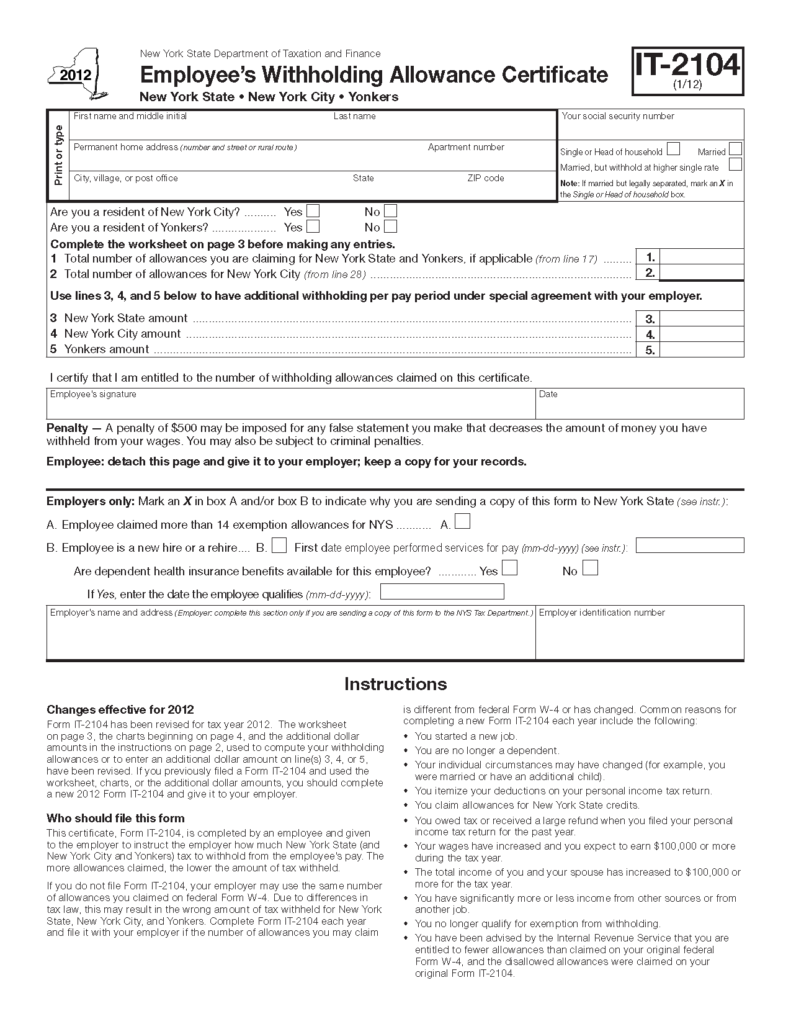

The Form W-4 ought to be current every time a worker moves careers or experiences a modification of circumstances. When taxes are filed early in the year, the IRS can withhold a smaller sum of money; however, if too much is withheld early in the year, the employee might owe a sizable number of money in April. Fees and penalties and curiosity can be within the more taxes they might are obligated to pay. As a result, it’s critical that the employee complete Form W-4 as soon as possible.

An agreed-on portion of the employee’s settlement has to be withheld by the boss for FICA and income taxes. The appropriate taxes authority gets this withheld and after that it really is deposited. This particular type must be used to inform the state directory of the latest hire employees. You must ensure that the W-4 is not unlawfully changed, as an employer. You must always remind your staff to update their Form W-4 by December 1 of each year, because of this.

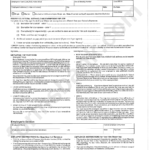

Form I-9

It is very important for that employer to correctly finish a Develop I-9 and get the necessary data to confirm the worker’s identification and eligibility for employment when prospecting a brand new worker. Before hiring the applicant, the employer should ensure the accuracy of the document list. The instructions to the Form I-9 will counsel you which files to request and what things to anticipate when sending the required papers. Three basic listings are normally provided on the varieties. The paperwork required to illustrate the employee’s identification and eligibility for career are listed in Checklist A.

Type I-9 papers must be maintained for a established period of time right after a member of staff is employed and should be around to approved employees. The Section of Homeland Security, the Department of Labor, along with the Division of Justice’s Immigrant and Employee Legal rights Area are amongst these accepted firms. You might need to change the shape or go without one fully according to what your location is located. You can access an educational webinar if you have inquiries about Form I-9 compliance, by registering for the HRCI or SHRM.

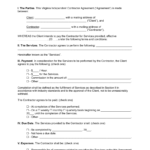

job deal

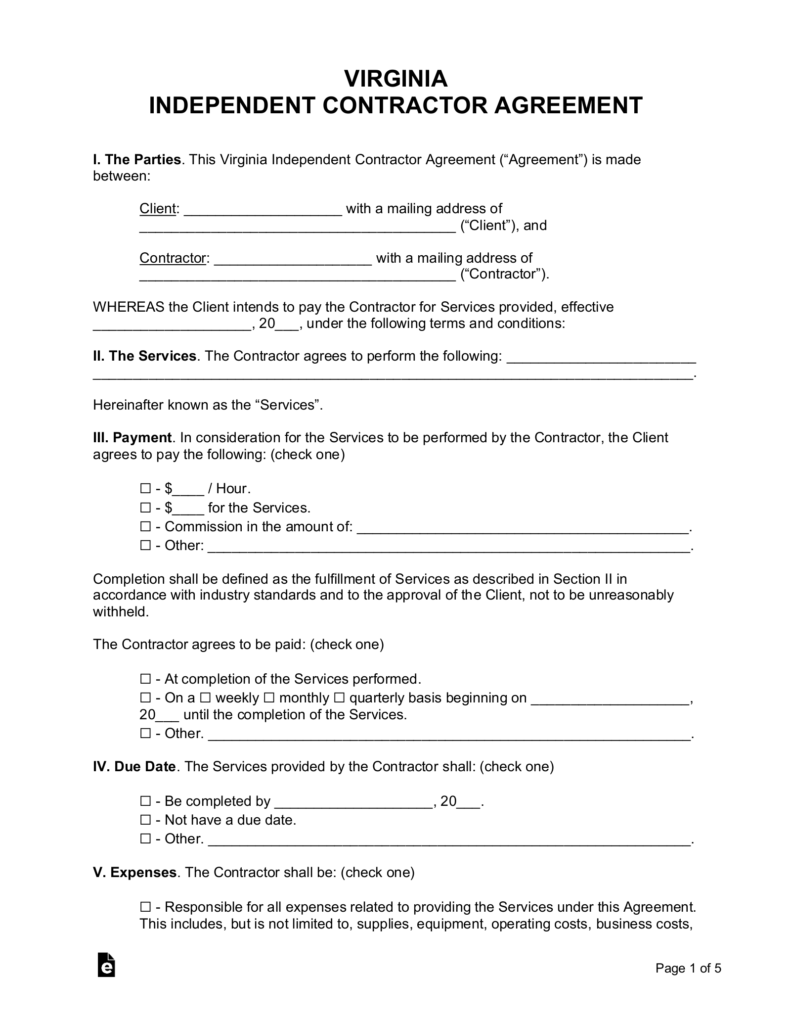

It’s crucial to notice labour restrictions when using new employees and also to get them signal a binding agreement. The details of the task must be specific from the work contract for a whole new work with personnel. It ought to include details about the employee’s pay out, hours worked well, bonus deals, and stock possibilities. Benefits like 401(k) coordinating, medical insurance, dental treatments, commuter advantages, and paid for time off for household also need to be integrated. If the employee will get certain benefits during their employment, this clause should be inserted in the contract.

While not unique, an job commitment does consist of considerable info. The start date, start off time, form of employment, and regardless of whether the Employee is going to be able to get enterprise from your Employer’s customers should be obviously explained inside the agreement. The completion time and the chance of an extension ought to be provided. An employee should always request a copy of the employment contract, before signing anything. Finally, a low-compete clause and a half a dozen-calendar month recognize time period right after termination ought to be included in an career agreement.

Type for direct downpayment

A Primary Down payment Kind needs to be given to every new selecting you make. This file enables the transfer of money through the employee’s banking account and contains information regarding primary downpayment. The employee is going to be encouraged to provide contact details, bank account information, and crisis information. It ought to be presented to the newest employee within a safe place. If you use an outside payroll agency, you can transmit the form electronically.

Make the kind has very clear directions. Options like selecting the most functional time to downpayment a check and splitting paychecks needs to be included in these instructions. It must also include consents to deliver the employee’s wage into several banking accounts. The authorization in the personnel to help make these deposits also need to be explained in the type. It will also specify if the obligations are required being made. The form should likewise include affirmations to minimize the employer’s culpability.

acknowledgment develop for your worker handbook

A worker handbook acknowledgement develop ought to be delivered to new hires at the outset of their career with the organization. It will likely be documented in the develop that this employee has read and comprehended the handbook. The shape may also be aware that it must be the employee’s accountability to comprehend and read the manual, how the employee is acquainted with the plans, which the employee confirms to adhere to them. The guide book must also make crystal clear that alterations might be created anytime. The staff member handbook can also get a powerful day, a revision or edition amount, along with a declaration that it model replaces all the other iterations. Furthermore, there should be room around the develop for that employee’s label and trademark.

All employees must be asked to comprehensive the worker manual acknowledgement type. If they refuse to sign the paperwork, although the employee may not be a suitable fit for the business. Other choices are available if that is the case. The HR skilled can easily make a notation about the type showing the worker was considering the manual and educated from the insurance policies as opposed to inquiring these people to indicator it.